47+ is it better to pay property tax with mortgage

The first is paying it as part of your monthly mortgage payment the preferred method for most lenders. If youre like most people your taxes and insurance were.

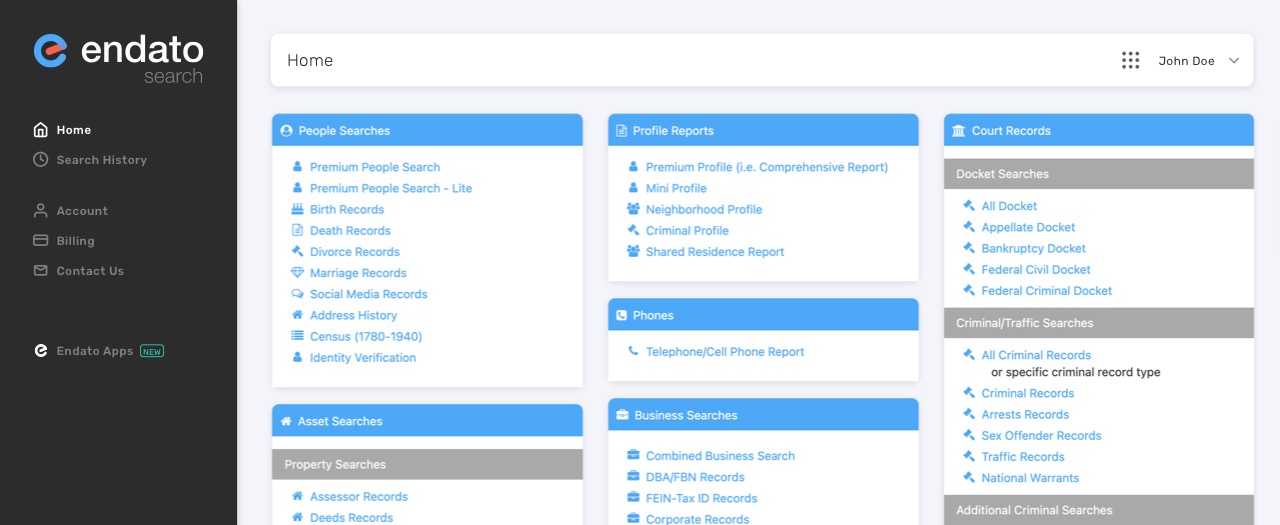

Endato The Leading People And Data Search And Api Platform

Web A mortgage payment calculator is a powerful real estate tool that can help you do more than just estimate your monthly payments.

. Web There are two main ways to pay your property tax bill. Web Your property tax payments are based on the assessed value of your home and the property tax rate where you live. Your financial institution holds.

Web Under federal tax law the mortgage interest and local property taxes you pay may decrease the portion of your income that is subject to tax. For example the current tax rate in Toronto is. You Get a Tax Break Because of Your Property Taxes.

Web Mortgage interest is tax deductible. If your homeowners insurance. Thats easy to forget about at least at first.

At a personal tax rate of 24 this implies tax savings of 3566. Your lender will estimate your property taxes and add that amount to the sum withdrawn from your account as your mortgage payment which makes it easy to. You Might Be Allowed To Pay Your Property Taxes With a Credit Card.

To find out if these will have an. Web According to SFGATE most homeowners pay their property taxes through their monthly payments to their mortgage lendersIn fact lenders often require monthly. If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you decide.

Web If your real estate property tax bill is 3000 per year the lender will set the monthly amount you pay into the escrow account at 250. Web A mortgage lien is a claim to your property until you make good on your liability in this case property taxes. Web Even if it isnt required paying property taxes through an escrow account with your mortgage is usually more convenient and your lender may offer you a better.

Web You still have to pay property taxes. Web Eligible W-2 employees need to itemize to deduct work expenses. Web Paying your property taxes through your mortgage means you dont have to worry about keeping track of when your taxes are due.

The federal government can choose to extend it or eliminate it in the future which means that the tax savings you. If you dont pay your taxes the county can put a lien. Web Property taxes or real estate taxes are paid by a real estate owner to county or local tax authoritiesThe amount is based on the assessed value of your home and.

Web The mortgage interest tax deduction is not a permanent deduction. You Can Pay Your Property. For example Lenas first-year interest expense totals 14857.

Here are some additional ways to use our.

Growing Your Real Estate Business Follow Our Steps To Hiring Marketing For Real Estate Companies

Floating Vs Fixed Interest Rate Home Loan Which Is Better Axis Bank

Are Property Taxes Include In Mortgage Payments How The Bill Is Paid

47 Sample Credit Agreements In Pdf Ms Word

Tbd Highway 194 Banner Elk Nc 28604 Zillow

Eu Council Manual Law Enforcement Information Exchange 7779 15

Should You Roll Your Property Taxes Into Your Mortgage Payments Or Pay Them Directly Darren Robinson

5 High Cost Cities To Live In Germany Manya The Princeton Review

Real Estate Taxes Vs Property Taxes Defined Explained

Should You Pay Property Taxes Through Your Mortgage Loans Canada

Are Property Taxes Included In Mortgage Payments Sofi

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

Endato The Leading People And Data Search And Api Platform

Property Taxes And Your Mortgage What You Need To Know Ramsey

Tips To Buy Mortgaged Property With The Help Of A Home Loan Axis Bank

4575 Brown Rd Mount Ulla Nc 28125 Zillow

Should You Pay Property Taxes Through Your Mortgage Ratehub Ca